understanding cap rates

Cap rates are also not fixed. They fluctuate according to the changes in the building's value and NOI. Market conditions, investor improvements and property upgrades can also impact the return value.

Additionally, debt is not considered in cap rates. Other return metrics should be considered, such as cash/cash returns and the internal rate of Return (IRR), as they give a wider picture about the potential.

Many advisors would tell you that a higher rate of return is better. Part of this is true. An investor should invest in property with higher cap rates because they predict higher yields. Cap rates are not everything. Investor risk appetite, property location and property condition, potential growth of NOI, as well as many other investment-specific considerations should all be considered when deciding to purchase a property. If you are a risk-averse investor, low cap rates could be worth considering.

Cap rates are also not fixed. They fluctuate according to the changes in the building's value and NOI. Market conditions, investor improvements and property upgrades can also impact the return value.

Real estate investors are often asked the question "What is an acceptable cap rate?". There is no universal cap-rate that can be targeted. This depends on many factors. If you're frustrated by an "it depends!" response, the broker package that lists comparable sales rates is the best place to find guidance on possible cap rate for buying an asset. Take care to not make assumptions about the asset's actual comparability, as they may have been cherry-picked.

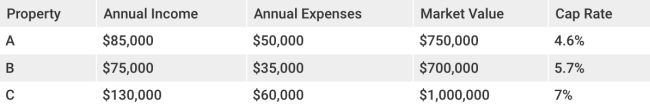

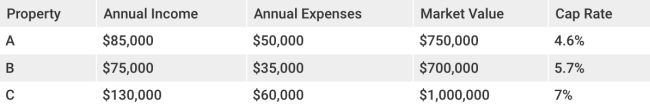

Cap rates can help you determine whether an investment will be "better" and/or more risky. A lower cap rates is usually associated with safer investments or less risky investments, while higher caps are associated with more risks.

All things being equal, an investor should only invest in the property that has a higher rate of return.

You can calculate the value for a building by using the same cap rates formula. For example, let's say that you know the property is generating $500,000 per year and that the market cap rate for a similar project would be 5%. Then you divide $500,000 by $5 million to get a $10,000,000 valuation. The same project may be worth just $8.3million, if the appropriate market cap is 6%. This illustrates how shifting market expectations (in our case, the caprate), can cause implied estate values to fluctuate.